Where Kroger, Albertsons, Antitrust, Inflation and Construction Intersect

Table of Contents

- The Kroger-Albertsons Merger

- How Corporate Consolidation Influences Construction

- The Market’s Impact on Mergers

- Navigate Market Consolidation Efficiently

Updated 4/23/2025.

The $24.6 billion proposed merger between Kroger and Albertsons, two of America’s largest grocery chains, was recently blocked by the Federal Trade Commission (FTC), citing concerns about reduced competition and inflated consumer prices. This decision not only highlights the complexities of antitrust regulations, but also sheds light on how corporate consolidation impacts industries like construction.

Related: What is Infrastructure, and Why You Should Know Where It’s Being Built?

The Kroger-Albertsons Merger

Kroger’s $25 billion proposed merger with Albertsons, which would have combined two of the largest grocery chains in the U.S., was recently blocked by two judges. Citing concerns over competition and potential harm to consumers. According to experts, the merger’s failure stemmed from a narrow definition of competition put forth by Kroger and Albertsons, who argued that combining their operations was essential to compete with nontraditional grocery retailers like Walmart, Costco, Amazon, and Aldi. However, the judges rejected this view, emphasizing that the merger would reduce consumer choices and likely lead to higher prices.

Following the judges’ ruling, Albertsons announced it would call off the merger and file a lawsuit against Kroger for mishandling the process. In response, Kroger dismissed the lawsuit as “baseless” and proceeded to announce a $7.5 billion stock buyback, signaling its intent to continue its operations independently. A central issue in the court’s decision was the proposal to sell 579 stores to C&S Wholesale Grocers, which was deemed insufficient to maintain adequate competition. Experts noted that C&S, with fewer than 24 stores, was not considered a serious competitor capable of absorbing the market share left by the merger, rendering the divestiture plan inadequate.

What Does Building Green Mean in Construction, and How Can It Save You Money?

How Corporate Consolidation Influences Construction

Increased Demand for Construction Projects

Mergers and acquisitions often lead to new construction activity, with specific job types varying depending on the nature of the project. For distribution centers, especially large-scale facilities like those used by Amazon, jobs typically involve extensive site preparation, civil engineering, structural design, and specialized construction for warehouse operations, such as adding cold storage, installing conveyor systems, and optimizing for large-scale logistics operations.

Retail spaces undergoing renovations to accommodate merged brands may involve jobs in interior design, FF&E (Furniture, Fixtures, and Equipment) procurement, electrical and plumbing updates, and aesthetic redesigns to ensure alignment with the new branding. Additionally, these retail projects might also include construction for expanded customer areas or updated back-of-house facilities.

Related: Top 12 Food and Grocery Deliverers in the US.

Challenges for Construction Schedules and Labor Costs

The increased demand for construction projects brings about several challenges. Rising material costs, often driven by factors like tariffs, especially under policies such as Trump’s trade tariffs on steel and aluminum, may contribute to price fluctuations in construction materials. With the new administrations favorable tax policies for real estate, this can provide some relief to construction projects that rely on financing, as borrowing costs become more predictable.

Furthermore, the growing number of construction projects exacerbates competition for skilled labor, particularly in a workforce largely composed of immigrants. Trump’s approach to immigration, including stricter policies and reduced opportunities for migrant workers, has impacted the labor pool. Many construction workers in the U.S. are immigrants, both legal and undocumented, and any reduction in their availability due to immigration restrictions can lead to labor shortages, delays, and challenges in maintaining quality standards across multiple sites. These factors make it increasingly difficult to manage construction projects efficiently and cost-effectively.

Related: Planned HEB Grocery Stores in Texas.

The Market’s Impact on Mergers

We have seen an uptick in mergers and acquisitions, as companies anticipate a regulatory environment more favorable to consolidation. This shift could particularly impact industries like healthcare, where private equity firms have ramped up investments in medical facilities and practices. The increased role of private equity in consolidating healthcare, especially in sectors like dermatology, orthopedics, and cardiology, mirrors trends in other industries, including construction.

According to a report from the Physicians Advocacy Institute and Avalere Health, the percentage of physicians employed by corporate entities has risen from 15.3% in January 2019 to 22.5% in January 2024. Corporate ownership of medical practices has also increased, now surpassing hospital-owned practices. This trend, driven by private equity interest in sectors like dermatology, orthopedics, and cardiology, signals a broader wave of consolidation within healthcare. As this pattern expands into other areas of medicine, we may see similar moves in industries like construction, with significant investments aimed at consolidation and growth opportunities.

Related: 4 Big-Box Retailers That Have Added Grocery Sections in Recent Years.

Effects on the Construction Industry

The increase in mergers and acquisitions could bring significant changes to the construction industry, with more opportunities for new projects across retail, healthcare, and hospitality sectors. However, this rise in development activity could also place greater pressure on supply chains, potentially exacerbating challenges in meeting the demand for construction materials and skilled labor, as more projects enter the pipeline.

Related: Why Grocery Stores Should Use Delivery Service Data.

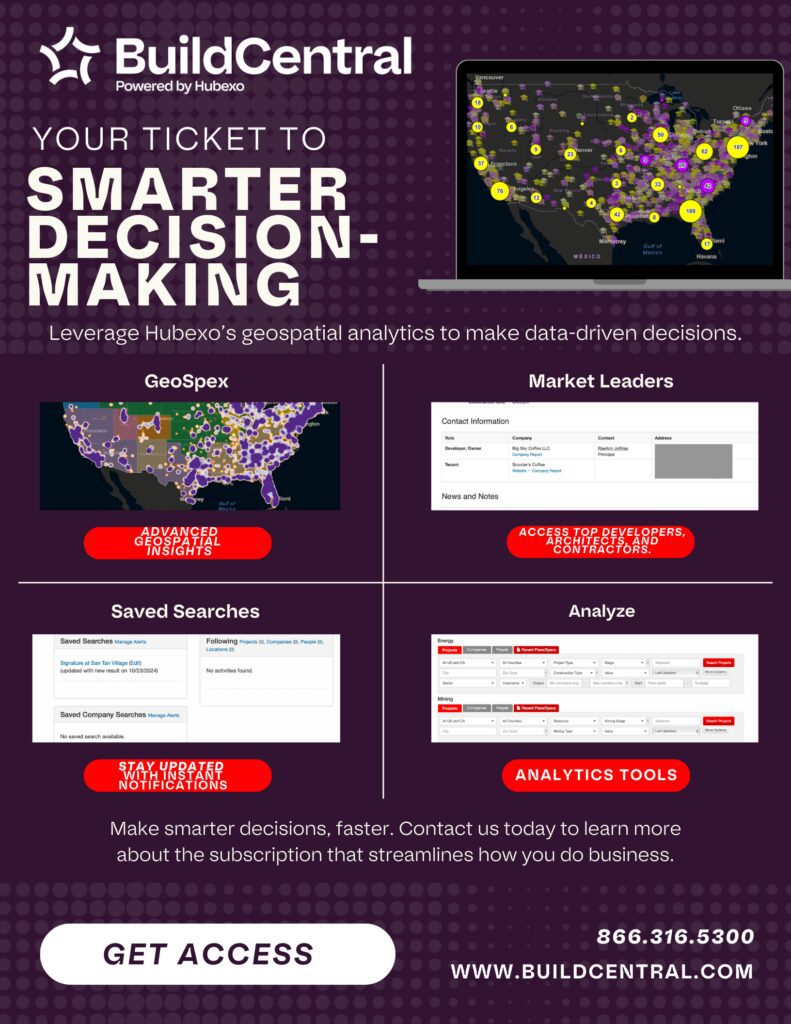

Take Control with Hubexo’s Tools

Understanding how corporate consolidation affects construction requires data-driven insights and geospatial data. Hubexo’s tools equip you with a comprehensive suite of tools to empower your decision making. In a world where construction looks to be more costly and more time-consuming, and where new developments face even greater pressure to show significant return from the jump, efficient lead generation, site selection, construction, market research, and competitive analysis are even more important. We offer solutions to all of that.

Ready to navigate the complexities of market consolidation? Book a demo with Hubexo today and discover how our tools can give you a strategic edge in the evolving construction landscape.

Read similar posts with important construction industry insights. on our blog page.