How are Gas Stations Responding to Market Consolidation?

The gas station industry is undergoing significant changes, driven by market consolidation and the rise of electric vehicles (EVs). As larger companies buy out smaller ones and the demand for EV infrastructure grows, gas station owners and investors must adapt to stay competitive. This article explores these dynamics and how gas station owners and investors are adapting to this rapidly changing landscape.

1. What is Market Consolidation?

2. The Rise of Electric Vehicles

3. Collaborations Between Gas Stations and EV Manufacturers

4. Strategic Location Choices for Gas Stations

5. Considerations for Gas Station Investors

6. Present-Day Fuel Demand

1. What is Market Consolidation?

Market consolidation refers to the process where smaller companies are absorbed by larger ones, leading to fewer players in the market. This can result in increased efficiency and cost savings for larger companies, but it also poses significant challenges for smaller, independent operators who may struggle to compete with well-capitalized chains.

Example 1: Generic Market Consolidation

In many industries, consolidation is a common strategy for growth and survival. For example, in the retail sector, large corporations often acquire smaller competitors to expand their market share and reduce competition. This not only streamlines operations but also allows for greater control over pricing and distribution.

Example 2: Market Consolidation in the Convenience & Gas Space

A concrete example of market consolidation in the gas station industry is the acquisition of Speedway by 7-Eleven in 2020. This $21 billion deal significantly expanded 7-Eleven’s footprint, making it one of the largest convenience store chains in the U.S. This consolidation allowed 7-Eleven to increase its market share and leverage economies of scale, but it also created challenges for smaller, independent gas station owners who now face even stiffer competition.

2. The Rise of Electric Vehicles

The rise of EVs is arguably the most significant trend impacting the gas station industry today. As more consumers adopt electric vehicles, the demand for traditional fuel is declining, while the need for EV charging stations is on the rise. This shift is driving new collaborations between gas stations and EV manufacturers.

If you’re interested in exploring opportunities in the gas station and commercial real estate market, or if you want to learn more about how these trends could impact your investments, be sure to check out our latest episode of the Brick and Mortar podcast with industry expert Marc Gomes.

3. Collaborations Between Gas Stations and EV Manufacturers:

- Sheetz & Tesla Superchargers: Sheetz has partnered with Tesla to offer Supercharger stations at their locations, providing added convenience for Tesla owners. Now with 650 EV chargers in 95 locations.

- Walmart & Electrify America: Walmart has collaborated with Electrify America to install EV charging stations in their parking lots, making it easier for shoppers to charge their vehicles while they shop.

- EVgo: EVgo is expanding its network of fast chargers in urban areas, including gas stations, parking garages, and mall parking lots.

- Buc-cees, Chevron, Shell, Pilot, BP, Kum and Go are among other gas stations that have partnered with EV manufacturers.

4. Strategic Location Choices for Gas Stations

Location is always a critical factor in the success of a gas station. Investors should consider the following locations when evaluating potential sites:

- Highway Interchanges: Traditional gas stations located at highway interchanges continue to be valuable, especially as they add EV charging stations for long-distance travelers.

- Mall Parking Lots and Urban Corners: As shopping malls and urban centers adapt to the rise of EVs, gas stations in these locations are incorporating EV chargers to attract more customers.

- Big Box Retailers: Retailers like Costco and Kroger, which already offer fuel services, are well-positioned to add EV charging stations, drawing in more customers who want to shop and charge their vehicles in one stop.

5. Considerations for Gas Station Investors

For commercial real estate investors, the shift towards electric vehicles presents new opportunities. By investing in gas stations that are adapting to EV trends, investors can benefit from:

- Increased Property Value: Gas stations that offer EV charging capabilities are likely to see an increase in property value as demand for EV infrastructure grows.

- Attracting a Broader Customer Base: By catering to both traditional fuel customers and EV owners, gas stations can attract a wider range of customers, boosting profitability.

- Long-Term Stability: As the market for EVs continues to grow, gas stations that have integrated EV charging stations will be better positioned for long-term success.

6. Present-Day Fuel Demand

While the long-term demand for traditional fuel is expected to decline, it’s important to note the present-day context. According to the U.S. Energy Information Administration (EIA), the forecast for U.S. oil demand has been adjusted upwards for 2024, with consumption expected to increase year-over-year. The EIA also forecasts tighter supply and demand balances, which could lead to higher crude prices by the end of the year. This indicates that while the shift towards EVs is undeniable, traditional fuel demand remains robust in the short term, particularly due to supply constraints and global economic factors.

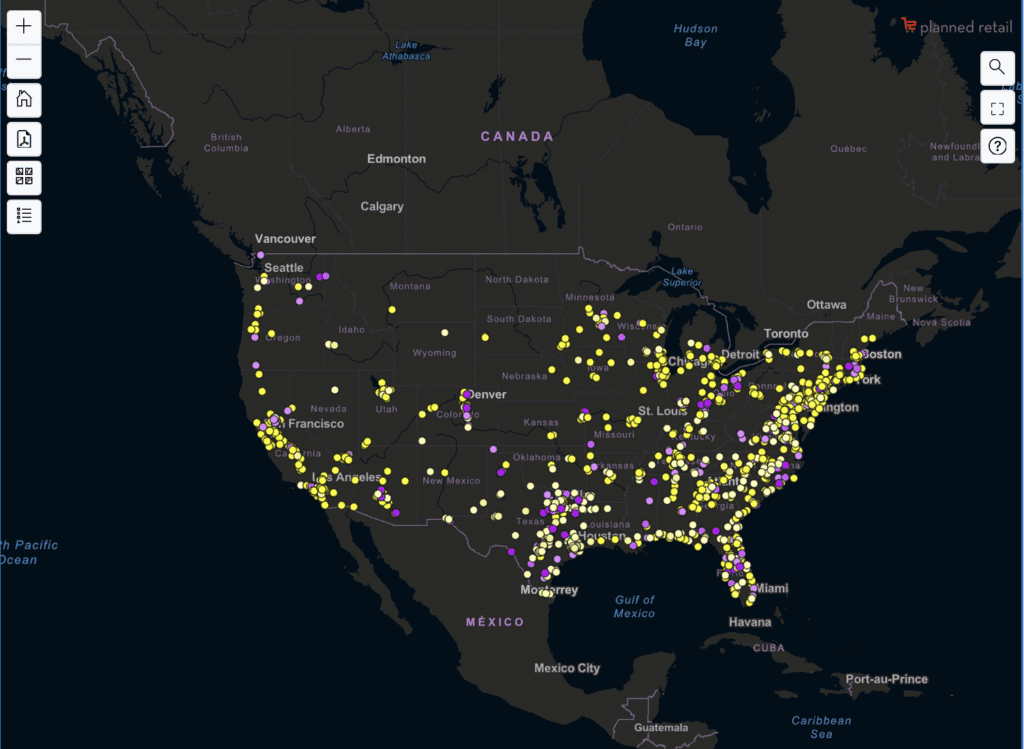

Get Started with BuildCentral!

Ready to take advantage of the changing landscape in gas station real estate? Contact BuildCentral today to discover how our data and insights can help you make informed investment decisions and stay ahead of the competition.