What Does the Fed Rate Cut Mean for Construction Starts?

The Federal Reserve’s 50 basis points (0.5%) rate cut in September 2024 marks an important moment for the U.S. economy, especially for the construction industry. After a series of rate hikes since early 2022 to combat inflation, this cut reflects the need for economic stimulus, particularly in light of persistent inflationary pressures and a slowdown in economic growth. Could this rate cut signal the beginning of a long-awaited uptick in new development starts?

Why Now and Why 50 Basis Points?

The decision to cut rates stems from a combination of economic pressures. Inflation, while not as severe as in recent years, still lingers. The Federal Reserve’s previous hesitations to lower rates were due to concerns about exacerbating inflation, but the September cut acknowledges that borrowing costs were stifling economic growth. Executives like John Sullivan of DLA Piper welcomed the cut, noting that lower borrowing costs will eventually encourage real estate investment and construction activity.

However, not everyone agrees with this approach. Some argue that inflationary concerns haven’t been fully addressed, and that a rate cut might reignite price pressures. Yet, with many projects on hold due to high interest rates, the cut was seen by most industry leaders as necessary to revive deal-making.

What Does the Federal Funds Rate Have to Do with Construction?

New construction projects often require substantial financing, and interest rates directly impact borrowing costs. When rates are high, borrowing becomes expensive, discouraging developers from initiating new projects. Conversely, lower rates decrease the cost of capital, making it easier for firms to finance developments. Historically, higher rates have slowed building activity, while rate cuts lead to renewed interest in construction projects.

The Timing of Market Shifts After Rate Cuts

Although the rate cut is expected to spur more construction activity, industry leaders caution that this shift won’t happen immediately. Construction is typically a lagging economic indicator, and project cycles take time to adjust. According to Construction Dive, executives predict that demand for new projects will rise gradually throughout 2025, aligning with historical patterns where rate cuts lead to increases in construction starts after financing terms and project planning catch up with lower borrowing costs. Builders may prefer a more measured, sustainable, and data-driven approach, For example, Turner Construction is making significant strides in reducing its carbon footprint. The company has implemented initiatives such as piloting electric and hybrid heavy equipment on projects and adopting zero-carbon cement.

Housing, Occupancy, and Interest Rates

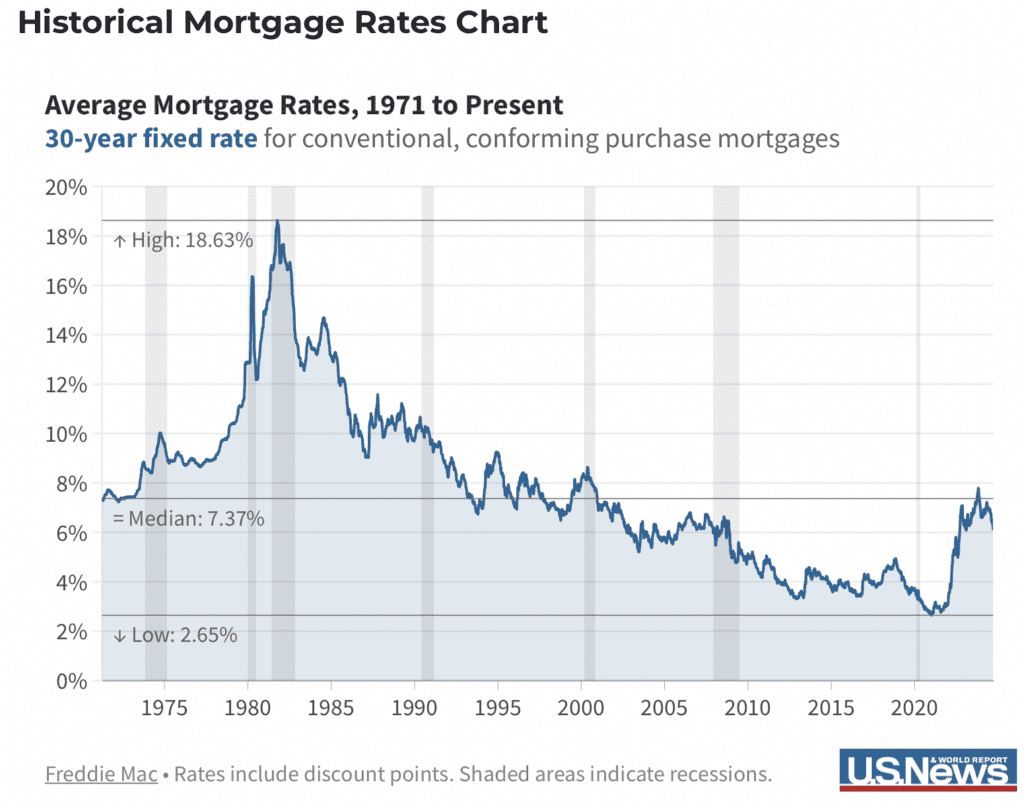

While the rate cuts are expected to lower mortgage rates slightly, the benefits may not be as significant as anticipated. Currently, mortgage rates sit at around 6.2%, and economists predict they could drop to 5.5% by the end of 2025. However, this decrease is unlikely to ease affordability concerns for first-time homebuyers or alleviate the housing shortage.

The real challenge remains a shortage of starter homes. Even though lower mortgage rates could spur homebuying and encourage developers to build more houses, affordability remains a significant issue. The cost of homes has surged by 50% since early 2020, far outpacing income growth. This imbalance makes it increasingly difficult for buyers to find homes within their budget, perpetuating the challenges of housing affordability .

Challenges from Rising Interest Rates

In the face of inflation and rising interest rates, the construction industry faces significant challenges. Bridgit highlights several key issues, including supply chain disruptions, material cost spikes, and expensive loans, all of which hinder growth. Supply chain problems have worsened, with material prices—such as lumber, steel, and concrete—remaining high, showing a 20% year-over-year increase according to Bureau of Labor Statistics data.

Additionally, rising construction costs have made loans more expensive, making it harder for businesses to secure funding and leading to potential project cutbacks and layoffs, particularly for smaller firms.

BuildCentral’s Role in Supporting You Through Market Cycles

BuildCentral’s platform offers insights into where the next big developments will occur, helping developers, investors, and other professionals navigate the landscape of rate cuts and opportunities. With accurate data on planned projects, BuildCentral equips users with the tools to anticipate market changes.

Request a demo to keep ahead in this changing landscape and see how BuildCentral can support your data-driven construction strategies.

Frequently Asked Questions

Lower interest rates reduce borrowing costs, likely leading to increased CRE developments, especially in sectors like multifamily housing and data centers.

Capital-intensive projects such as healthcare facilities and data centers benefit the most from lower interest rates due to reduced financing costs.